An Australian Business Number (ABN) is a key identifier used by businesses and sole traders in Australia for a wide range of administrative, financial, and legal purposes. If you’re searching, “how do I find out my ABN number,” you’re not alone. Many Australian business owners need to retrieve their ABN for tasks such as submitting tax forms, applying for loans, or updating records.

The Australian Business Register maintains millions of ABNs across a wide range of industries, covering businesses, sole traders, partnerships, and other entities. These numbers are issued to business entities so they can interact legally with government departments, claim GST, and operate in compliance with Australian law. Retrieving your ABN is essential when submitting Business Activity Statements (BAS), applying for loans, onboarding with clients, or updating superannuation records.

This article outlines the different ways to locate your ABN, explains what to do if it’s inactive or cancelled, and provides tips for reactivating or applying for a new ABN. It also includes advice for locating your super fund ABN number, another important piece of information for employers and contractors.

Australian Business Numbers (ABNs)

An ABN is an 11-digit identifier issued by the Australian Business Register (ABR). It enables businesses and other entities to:

- Register for Goods and Services Tax (GST)

- Lodge tax returns

- Issue legal tax invoices

- Purchase from wholesalers

- Avoid the pay-as-you-go (PAYG) tax on income

Types of Entities That Require an ABN:

- Sole traders

- Companies

- Partnerships

- Trusts

- Government entities

- Non-profit organisations

Each of these entities must have a valid ABN to legally trade in Australia. Additionally, the ABN must be used on all official documents and transactions, including purchase orders and invoices.

ABN vs ACN

It’s important to distinguish between an ABN and an ACN (Australian Company Number). While an ABN applies to all business structures, an ACN is a 9-digit number issued only to registered companies by ASIC (Australian Securities and Investments Commission). Companies must use both numbers in different contexts — ACNs for legal company registration and ABNs for tax and commercial activities.

The Importance of Your ABN

Your ABN plays a critical role in how your business is perceived and how it operates within Australia’s regulatory environment. From issuing invoices to dealing with suppliers and the ATO, a valid ABN ensures your business activities are recognised as legitimate and compliant.

Why You Must Have a Valid ABN:

- Tax Invoicing: Businesses must include their ABN on invoices. Without it, clients may withhold up to 47% of payments as PAYG withholding tax.

- GST Registration: Only businesses with a valid ABN can register for GST, which is mandatory for those earning over $75,000 annually.

- Avoid Penalties: Not displaying an ABN where required can lead to fines or compliance issues.

- Professional Credibility: Potential partners and clients often verify your ABN before doing business. An invalid or cancelled ABN can hinder opportunities.

This is especially crucial for freelancers, consultants, online sellers, and small businesses who manage their own financial and legal records.

How Do I Find Out My ABN Number (Methods That Work)

There are multiple ways to find your ABN if it has been forgotten or misplaced. These range from using online tools to reviewing official records or contacting the relevant government bodies.

Using the ABN Lookup Tool

The ABN Lookup tool is a free government service available. You can search using:

- Your legal name

- Your trading name

- A previous ABN (if available)

How to Use ABN Lookup:

1. Go to the website and enter your details.

2. Review the search results and identify your business based on address and registration date.

3. Click the correct record to view:

-

- ABN status (Active or Cancelled)

- Entity type (e.g., Sole Trader, Company)

- GST registration

- Business name history

This is one of the most reliable ways to answer the question, how do I find out my ABN number, using official records.

Reviewing Your ATO or Business Documents

Official correspondence often contains your ABN. Check:

- ATO letters and emails

- Business Activity Statements (BAS)

- Tax return summaries

- ASIC registration documents (for companies)

- Invoices, receipts, and supplier forms

- Lease agreements or business applications

Most businesses will find at least one document listing their ABN in physical files or cloud storage.

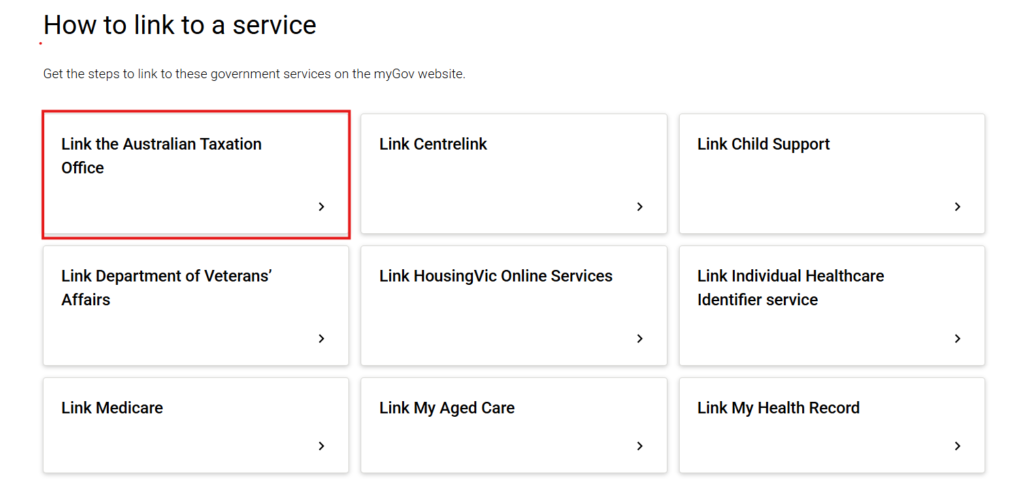

Accessing myGov Linked Services

Is ABN linked to myGov? Yes. If you’ve connected your business details:

1. Log in to my.gov.au

2. Click on ATO under ‘Linked Services’

3. Navigate to the ‘Business’ tab

4. Locate your entity’s information, including your ABN

This method is ideal for sole traders and businesses using myGov for tax and BAS lodgements.

What If Your ABN Doesn’t Appear?

Sometimes your ABN may not appear in lookup tools. Common causes include:

- Long-term inactivity leads to cancellation

- Typing errors in the search

- Data mismatches due to business name changes

If this occurs:

- Use your TFN to cross-check with the ATO

- Log in to your ABR portal to view registration details

- Contact the ATO for reactivation or guidance

Reactivating a cancelled ABN is possible if your business has resumed under the same structure.

Start Your ABN Application in Minutes

If you’ve never had an ABN or need to register again, follow these steps:

- Go to abr.gov.au

- Choose your business structure (sole trader, company, etc.)

- Enter your TFN and identity verification details

- Fill in your business details and submit

Once processed, your ABN is issued instantly or within a few days. Save both a digital and printed copy of your ABN confirmation for future tax and compliance purposes.

Reapplying for an ABN

In some cases, your ABN may be cancelled due to inactivity or because the ATO believes your business has ceased operations. If your business is now active again, you may not need a new ABN — reactivation may be possible.

When to Reactivate vs Apply Anew:

- Reactivate ABN Number: If your business structure has not changed, and you are continuing similar activities.

- Apply for a New ABN: If you’ve changed your legal structure (e.g., from sole trader to company), a new ABN is required.

Common Reasons for ABN Cancellation:

- No recent income or business activity reported

- Failure to lodge BAS or tax returns

- Incorrect information during the last update

- ATO compliance reviews

To reactivate, visit the ABR site and follow the reactivation process using your existing TFN and business details. You may be asked to confirm your business is still operating and provide updated contact information.

Where Else to Check Your ABN Number Status

Beyond the ABN Lookup and official ATO records, your ABN is often stored in places you might not immediately think to check.

Additional Sources:

- Cloud accounting platforms: Tools like Xero, MYOB, and QuickBooks require your ABN for invoice generation.

- Business bank accounts: Some banks include your ABN in account application forms or online banking summaries.

- Email footers: Businesses that include ABNs in standard signatures can find records in sent mail.

- Commercial software platforms: Online marketplaces, vendor dashboards, or affiliate portals may request or display your ABN.

If you are looking to check ABN number status, make sure it is active and matches what clients or government bodies will see during verification.

Finding Your Super Fund ABN Number

A common point of confusion is the difference between your business ABN and your super fund ABN number. When completing superannuation forms or onboarding employees, you’ll need the ABN of your super fund, not your own business.

Where to Find Superfund ABN:

- Super fund websites: Major providers like AustralianSuper, Hostplus, and REST display their ABN on their contact or product disclosure pages.

- Annual statements: Your member statements often include the fund’s ABN and USI (Unique Superannuation Identifier).

- myGov account: Under the ‘Super’ tab, you can view details of your nominated fund, including ABN and fund name.

- ATO Super Fund Lookup: The Super Fund Lookup is an external register that contains publicly available information about super funds with an ABN, including their compliance status.

This information is essential when setting up contributions through payroll systems or registering new employees for super.

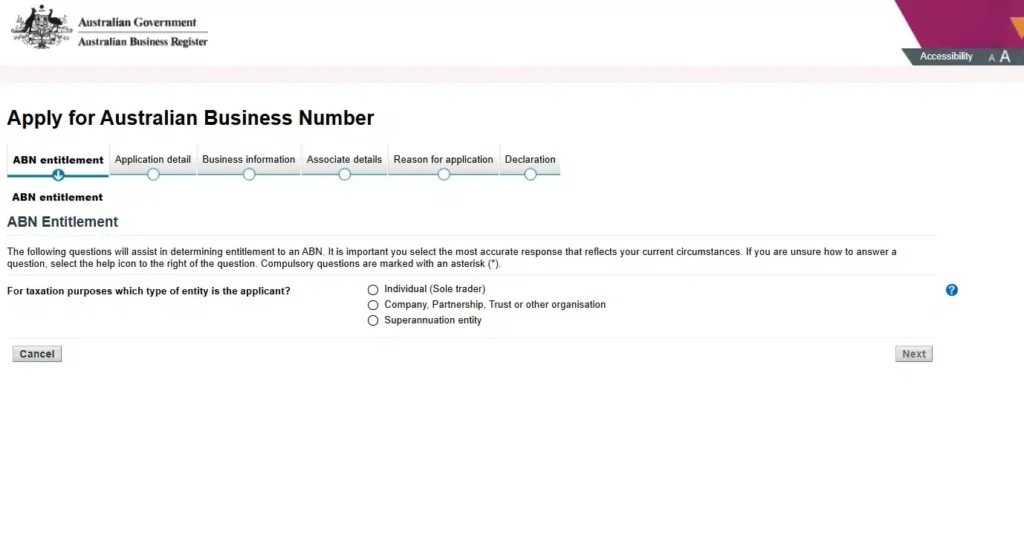

How to Create an ABN Number

If you are starting a new business, you’ll need to register for an ABN before trading. The process is relatively straightforward and can be completed online.

Steps to Register:

1. Visit the ABR site at https://abr.gov.au

2. Select your business structure (sole trader, company, etc.)

3. Provide your Tax File Number (TFN)

4. Enter your business name, address, and contact details

5. Indicate the nature of your business activity

6. Review and submit the form

Tips for a Successful Application:

- Ensure your business purpose is legitimate and clearly defined

- Use a valid physical address, not a P.O. Box

- Make sure your TFN matches your name and date of birth

- Save the confirmation email and registration number

Conclusion

If you’re wondering how do I find out my ABN number, there are several straightforward and reliable methods available. Tools like ABN Lookup, your ATO or tax records, and linked myGov services are reliable sources. If your ABN has been cancelled or is missing, it’s important to take action—either by updating your details or applying again through the Australian Business Register. Keeping your ABN active and accessible ensures smooth operations and avoids disruptions to your business obligations.

For professionals setting up a clinic or expanding an aesthetic practice, having the right infrastructure matters just as much as having the right credentials. Alma Lasers delivers clinically proven, results-driven technologies that help you stand out in a competitive market. From your first treatment room to your fifth clinic, we equip ambitious practitioners with the tools to grow with confidence.

Book a consultation with Alma Lasers to discover how our technologies can help you grow your clinic with confidence.